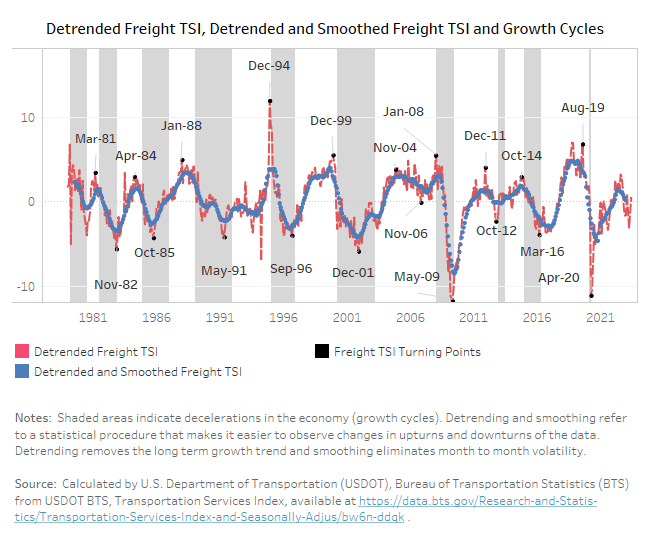

The US Department of Transportation believes that the volume of freight moved on the US rail system is a good indicator of the health of the US economy. They publish an indicator called the Transportation Service Index (TSI). The TSI measures the amount of goods moved on for-hire transportation and thus can be used as a sudo proxy for demand for goods in the US. The TSI has shown to begin to fall just before the economy begins to drop as seen in the chart below.

Unfortunately, the TSI is an aggregate average that combines all industries and all forms of transportation. It is hard to learn anything meaningful about a specific industry by looking at the TSI.

CSX Corporation is one of the nation’s largest rail transportation companies but more helpfully breaks down their revenues by industry in their 10-Q. By looking at CSX’s results, we might be able to see what industries are starting to show signs of slowing compared to last year. Below is a comparison of the volume shipped on CSX lines in the third quarters of 2023 vs 2022.

| Industry | 2023 | 2022 | % change |

|---|---|---|---|

| Chemicals | 161 | 162 | -1% |

| Agricultural and Food Products | 108 | 120 | -10% |

| Automotive | 101 | 85 | 19% |

| Minerals | 95 | 91 | 4% |

| Metals and Equipment | 70 | 67 | 4% |

| Forest Products | 67 | 75 | -11% |

| Fertilizers | 47 | 48 | -2% |

| Coal | 193 | 177 | 9% |

| Total | 649 | 648 | — |

The Total shows that there was almost no change in the overall volume of goods moved on CSX’s system. However, if we drill down, we will notice some double digit drops in Agriculture and Forest Products offset by an almost 20% increase in automotive. The management discussion of why they saw these changes are fascinating.

Agricultural and Food Products – “Decreased primarily due to lower shipments of feed grain, including the temporary impacts of a strong southeastern crop that is short-haul and not rail-served, as well as lower shipments of ethanol and wheat.”

This means the farmers in the southeast had a great year and feed grain, ethanol, and wheat producers shipped less product. Are you a commodity trader and understand if this is meaningful information? If you are, please, please reach out! I would love to pick your brain!

Forest Products – “Decreased primarily due to lower shipments of pulpboard, paper and lumber, partially offset by higher shipments of other building products.”

Google says that pulpboard is thick and fancy paper. Look out for a down third quarter at Dunder Mifflin 😉 . Seriously, I might speculate that lower lumber volume could show slowing in home builders.

Automotive – “Increased due to higher North American vehicle production as well as new business wins.”

I wonder if Tesla turned to rails to relieve their car delivery bottleneck? I wonder if the Unionized automakers popped out a few more cars ahead of looming labor strikes?

Conclusion

The CSX 10-Q might show some clues into the health of some US industries. I would want a few other data points before I traded on this information.

Casualty, Environmental and Other Reserves

CSX keeps reserve accounts on its balance sheet so they have funds available to pay future casualty and environmental claims. The amount has stayed consistent though the year at $435 million. This reserve is in addition and above the insurance they carry which covers up to $100 million per occurrence. It is obviously horrible when a train derails. That must be the worst day in all rail workers’ lives. I can’t think of another business that is forced to keep a contingency account in the apparently high likelihood the worst will happen.

The Total shows that there was almost no change in the overall volume of goods moved on CSX’s system. However, if we drill down, we will notice some double digit drops in Agriculture and Forest Products offset by an almost 20% increase in automotive. The management discussion of why they saw these changes are fascinating.

Agricultural and Food Products – “Decreased primarily due to lower shipments of feed grain, including the temporary impacts of a strong southeastern crop that is short-haul and not rail-served, as well as lower shipments of ethanol and wheat.”

This means the farmers in the southeast had a great year and feed grain, ethanol, and wheat producers shipped less product. Are you a commodity trader and understand if this is meaningful information? If you are, please, please reach out! I would love to pick your brain!

Forest Products – “Decreased primarily due to lower shipments of pulpboard, paper and lumber, partially offset by higher shipments of other building products.”

Google says that pulpboard is thick and fancy paper. Look out for a down third quarter at Dunder Mifflin 😉 . Seriously, I might speculate that lower lumber volume could show slowing in home builders.

Automotive – “Increased due to higher North American vehicle production as well as new business wins.”

I wonder if Tesla turned to rails to relieve their car delivery bottleneck? I wonder if the Unionized automakers popped out a few more cars ahead of looming labor strikes?

Conclusion

The CSX 10-Q might show some clues into the health of some US industries. I would want a few other data points before I traded on this information.

Casualty, Environmental and Other Reserves

CSX keeps reserve accounts on its balance sheet so they have funds available to pay future casualty and environmental claims. The amount has stayed consistent though the year at $435 million. This reserve is in addition and above the insurance they carry which covers up to $100 million per occurrence. It is obviously horrible when a train derails. That must be the worst day in all rail workers’ lives. I can’t think of another business that is forced to keep a contingency account in the apparently high likelihood the worst will happen.

Leave a comment